This time of the year, every where you turn, there is a “challenge” of some sort. Which is fine, because challenging yourself is a good thing. When it comes to challenging yourself financially it can be tough. I’ve posted in the past about the 52 week money challenge but the complaints I hear about it are that it’s too hard to save $50, $51 and $52 in three consecutive weeks at the end of the year. And I get that. That’s a big chunk of change to put back – especially around Christmas. You can do it in reverse, starting with the highest amounts at the beginning of the year, but that still means finding $200 extra in one month to put in savings. There are months when I don’t have an extra $200. You can try the modified plan that has you putting back about $110/month or $27/week.

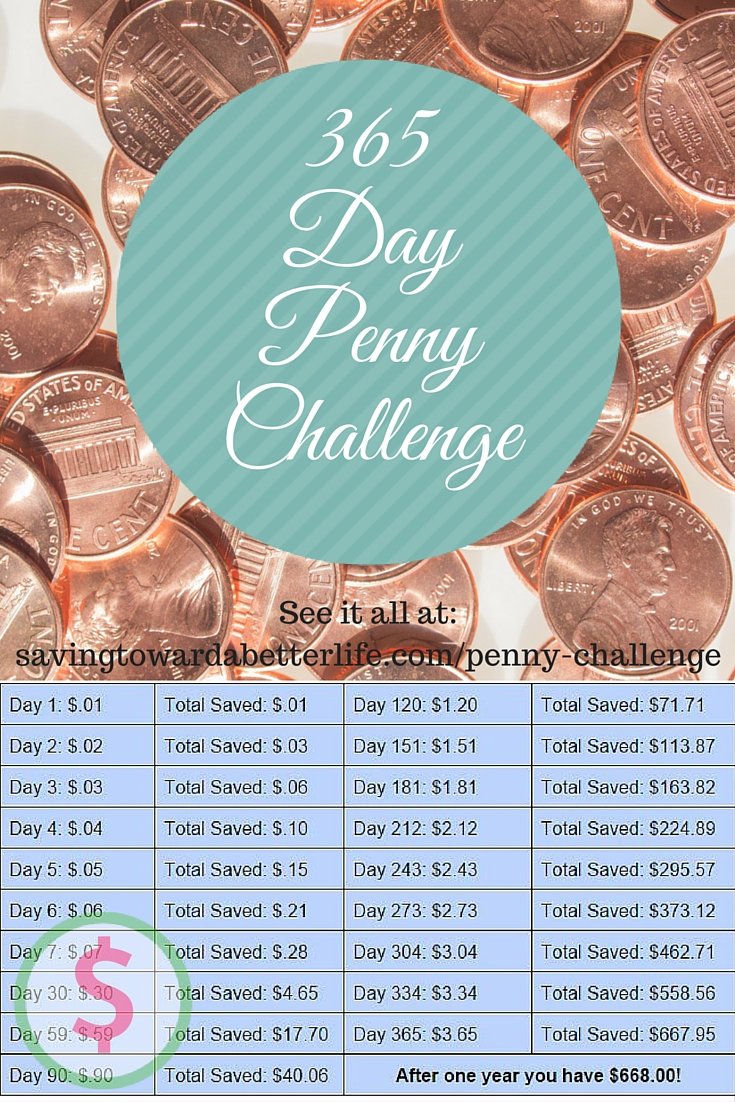

Here is the 365 Day Penny Challenge. The return is less than half the savings of the bigger challenge, but savings is savings and $668 at the end of the year is better than nothing! The concept is saving a penny on the first day and adding a penny to your savings amount every subsequent day. Day one you save a penny, day 2 you save 2 pennies for a total of 3 cents. Day 3 you save 3 pennies for a total of 6 cents saved, etc etc. Here’s how it breaks down:  If you start at the beginning of the year Day 30 would be January 30th. Day 59 is the end of February, Day 90 is the end of March, Day 120 is the end of April, etc, etc (see how I did that?)

If you start at the beginning of the year Day 30 would be January 30th. Day 59 is the end of February, Day 90 is the end of March, Day 120 is the end of April, etc, etc (see how I did that?)

I realize that by the end you’re saving a little more than pennies, I’m okay with putting quarters in the jar – you don’t have to find 365 pennies in one day to put in the jar. I guess I could’ve called it the 365 Day Spare Change Challenge. I don’t know, does it have the same ring to it?

The most you’ll put away in any one week is $25.34. And that’s the very last week. So if the 52 Week Money Saving Challenge doesn’t work for you because the high amounts at the end of the year is too much you might want to try the penny challenge!

If you’re afraid that $25.34 is too much the last week of the year, you can always do the last week at any other point in the challenge when you DO have the extra $25. You could even do the whole month of December ($109.39) when you have it – like say, after your tax refund? Yearly work bonus? And then just pick up where you left off and finish it out.

I don’t know about you, but for us, an extra $600 is MORE than enough to pay for Christmas. So let me hear from you in the comments – is this a better challenge than the 52 week challenge? Are you up for it?

Follow me on Facebook to find deals to help you save money!

Follow Me!