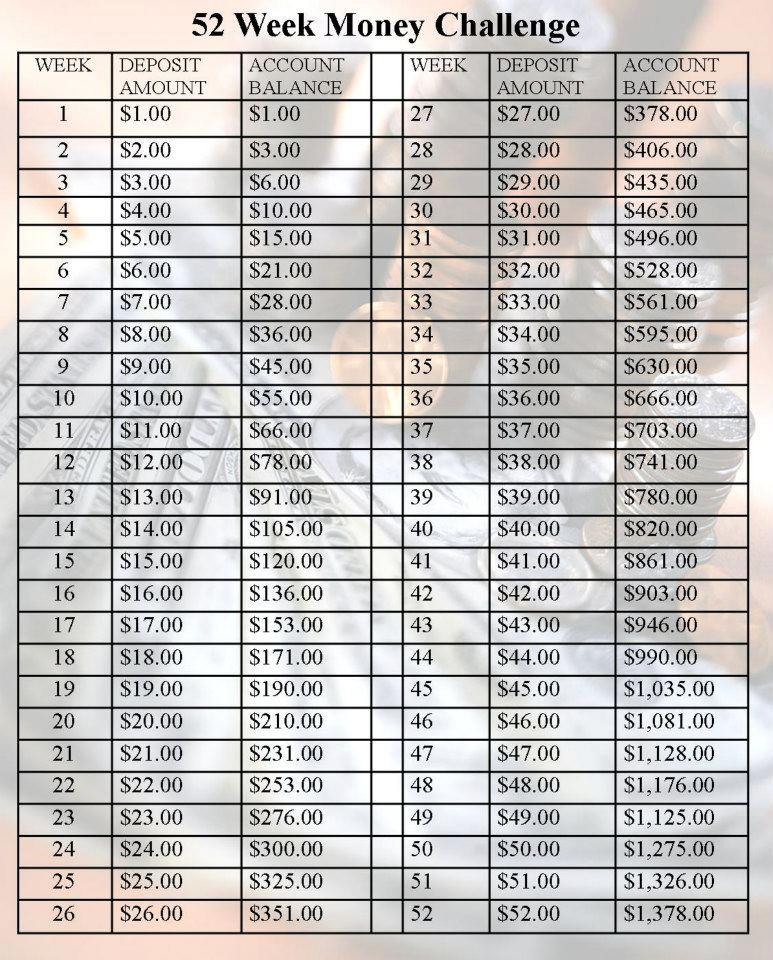

I’m sure by now you’ve seen the 52 Week Money Challenge floating around the internet. I even tried it for a while. But it just didn’t work for me. It’s a lot to keep track of…which week you’re on. And while the beginning is easy, $1/week, then $2, then $3. By the time you get to the end of the year (if you started in January) it’s now Christmas time and you’re having to “save” $48, $49, $50 and $51 over 4 consecutive weeks. That’s already a money-tight time of the year!

I’ve been brainstorming for a simpler way to save the same amount of money in a year. The 52 week money challenge saves you $1,378 at the end of challenge.

My improved way will save you $1,404 by the end of the challenge!

What are you saving for? A trip? A car? A rainy day? Share with us and we can encourage each other as we go!

So $1,378 comes out to $106/month or $26.50 per week. So I decided to round UP – and say we’re going to save $27 per week which will give you $1,404 by the end of the year!

And the great thing about this is, if you can increase your weekly savings by just $1 – to $28/week – that’s an EXTRA $52 at the end of the year – making your total $1,456.

In fact, for every ONE DOLLAR you can increase your weekly savings to it equals $52 at the end of the challenge (provided you start with the first week). If you can put aside $30 every week then you’ll have $1560 by the end of the year! That’s over $150 more than the challenge.

But isn’t it so much easy to say, “I need to add $27 to my savings by the end of the week” than having to think – is it $18 or $19 this week? If the $1 per week increments works for you – then more power too you because saving is saving – no matter how you do it! But I like the simplified version better!

Who is ready for the challenge? Keep reading for some ways you can cut costs to save your $27!

- Don’t let those gift cards you got for Christmas sit in your wallet! Use them! Did you get a Target gift card? Use it to buy groceries – if you spend a $25 Target gift card on groceries then take $25 cash out of your grocery budget and put it in savings – that’s almost all the money you’re supposed to save this week!

- Trim your spending! See what you can do without – Starbucks, eating out, any money you would normally spend – put it in savings!

- Check out fiverr.com to see what you can do to make $5! And you can do the same thing with Swagbucks. If you can earn enough Swagbucks to cash out via Paypal this month it’s free money! Since it’s not part of your budgeted income it can go into savings for your savings challenge!

- Sell something. Got something sitting around the house that’s of value? Sell it on Ebay or list it in a local buy/sell/trade group on Facebook. Put the money in savings!

- Cook from your stockpile this month! Just exactly how many meals can you make from what’s already in your fridge/freezer/pantry? You might be surprised! Do some creative meal planning and challenge yourself to cut your grocery budget this month! Spend $100 less than normal? AWESOME! That’s almost all you need to save for the WHOLE MONTH! You just need $8 more!

- Cut cable. Did you know that cutting cable can save you $900 or more a year? At the very least it can save you $75-$100 THIS MONTH. You know what I’m going to say, right? That’s almost the whole months savings! Here’s how to get started with (and survive!) no cable service! Can’t cut cable completely yet? Try to trim down your package and see if it can save you a few bucks. Or, call your cable company and ACT like you want to cancel service. We did this just before we cancelled and they gave us $10 off our bill for a few months. THEN we cancelled. $10 is not $75…but it is $10 – that will get you toward your savings goal this month!

- Ditch the landline phone. Really. We did this 9 years ago! (Years before we cut cable). That’s another $50 or so you can save a month!

I’m going to check back with you at the end of the month and see how much you’ve saved!

Follow Me!