This time of the year, every where you turn, there is a “challenge” of some sort. Which is fine, because challenging yourself is a good thing. When it comes to challenging yourself financially it can be tough. I’ve posted in the past about the 52 week money challenge but the complaints I hear about it are that it’s too hard to save $50, $51 and $52 in three consecutive weeks at the end of the year. And I get that. That’s a big chunk of change to put back – especially around Christmas. You can do it in reverse, starting with the highest amounts at the beginning of the year, but that still means finding $200 extra in one month to put in savings. There are months when I don’t have an extra $200.

This year I proposed this plan which gives you an amount equivalent to the 52 week plan but you put back the same amount – $27 – every week. That’s $108/month. For some of us, that’s more doable.

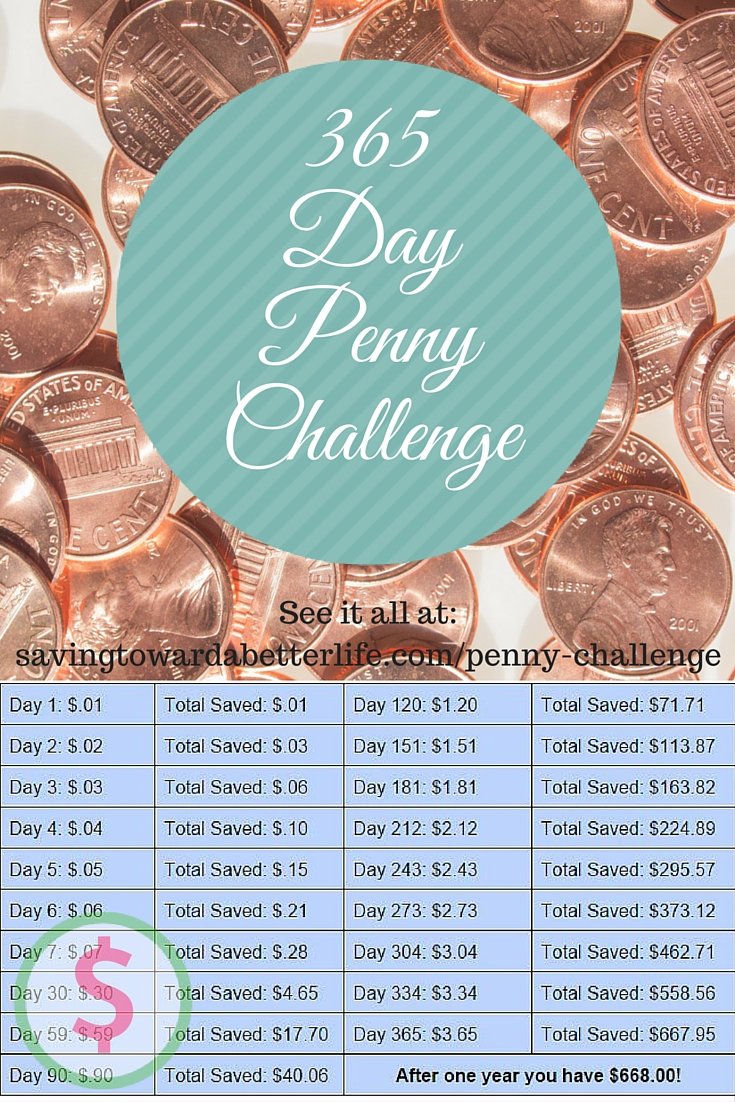

But if neither one of those works for you, here is the 365 Day Penny Challenge. The return is only half the savings of the bigger challenge, but savings is savings and $668 at the end of the year is better than nothing! The concept is saving a penny on the first day and adding a penny to your savings amount every subsequent day. Day one you save a penny, day 2 you save 2 pennies for a total of 3 cents. Day 3 you save 3 pennies for a total of 6 cents saved, etc etc.

Here’s how it breaks down:

If you start at the beginning of the year Day 30 would be January 30th. Day 59 is the end of February, Day 90 is the end of March, Day 120 is the end of April, etc, etc (see how I did that?) Even though it’s a few days into January, it wouldn’t be too hard to catch up. You could probably find enough change in the dryer or in your couch cushions to catch you up. I realize that by the end you’re saving a little more than pennies, I’m okay with putting quarters in the jar – you don’t have to find 365 pennies in one day to put in the jar. I guess I could’ve called it the 365 Day Spare Change Challenge. I don’t know, does it have the same ring to it?

The most you’ll put away in any one week is $25.34. And that’s the very last week. So if the 52 Week Money Saving Challenge doesn’t work for you because of the high amounts at the end of the year and the $27/week of the modified 52 week plan is to much you might want to try the penny challenge!

If you’re afraid that $25.34 is too much the last week of the year, you can always do the last week at any other point in the challenge when you DO have the extra $25. You could even do the whole month of December ($109.39) when you have it – like say, after your tax refund? Yearly work bonus? And then just pick up where you left off and finish it out.

2016 is actually a leap year and I didn’t factor that into the chart. So day 60 will actually be the end of February and every other “ending day” on the chart will be off by one. On the last day of the year you’ll put back $3.66 – for a final savings total of $671.61! I don’t know about you, but for us, an extra $600 is MORE than enough to pay for Christmas. In fact, it could probably pay for Christmas TWICE.

So let me hear from you in the comments – is this a better challenge than the 52 week challenge? Are you up for it?

I need a chart that shows me what day # a date corresponds with. For example March 15th is what day like, day 47 or is it 45?

Having to keep up with the date numbers all the way up to 365 is the challenge part of this penny challenge. With the Dollar Challenge it’s only done weekly and keeping up with the week number that only goes up to 52 is much easier.

Making a chart like that would take a while which is why I haven’t. It took me long enough to make the one in the post. But I did make it in a way to make it easier to determine the date.

If you start at the beginning of the year Day 30 would be January 30th. Day 59 is the end of February, Day 90 is the end of March, Day 120 is the end of April, etc, etc. So to use your example, if 59 is the end of February, 15 days later (March 15th) would be 74.

This year is a leap year and that chart doesn’t factor that in. But you can follow the chart, you’ll just finish on 12/30. You can always add $3.66 on December 31st if you want.

Hope that helps!

Takes seconds in excel. List the date in column A.List the day numbers in column B. List from 0.01p to 3.65p in column C. First cell of column D is 0.01p. Second cell is formula D1+C2. Drag this to the bottom and it’s done.

Do you happen to have one done that you would be willing to share? I’m a technological moron??♀️

My Mother amd I started in January. We are looking for others who is doing the Pennie Challenge. Our total for April was ,$31.95.

I started this on Jan 1,2016. I am hoping to count my money on Nov 10 to see how I did. My jar is extremely heavy.

Yes, I think this is a great way to start saving!

What a really great idea to save money. I think I will give it a try and see how far I can get. I don’t always have money to save everyday….

This is such a fun idea. A great way to save a little at a time. Thank you so much for sharing

Well, maybe I will start this next year, seeing that it’s the middle of May. Looks like a great idea!

wow that is really kind of cool!so awesome!

What a great way to save money!

52 weeks might be better for some, it just depends on the type of saver you are. Tips like this help a lot of people find easier ways to save, which is a great thing!

This is a great way to start saving.

I think this is a great savings tool! Thanks for sharing!

If you get a calendar from the dollar store and use it just for the 365 day penny challenge, it might be easy to just number the days and follow accordingly.

Great tip!

Some calendars have the days numbered.