Have you seen this circulating around? I can’t take credit for it because it wasn’t my idea. But I LOVE it and I am all onboard to do it!

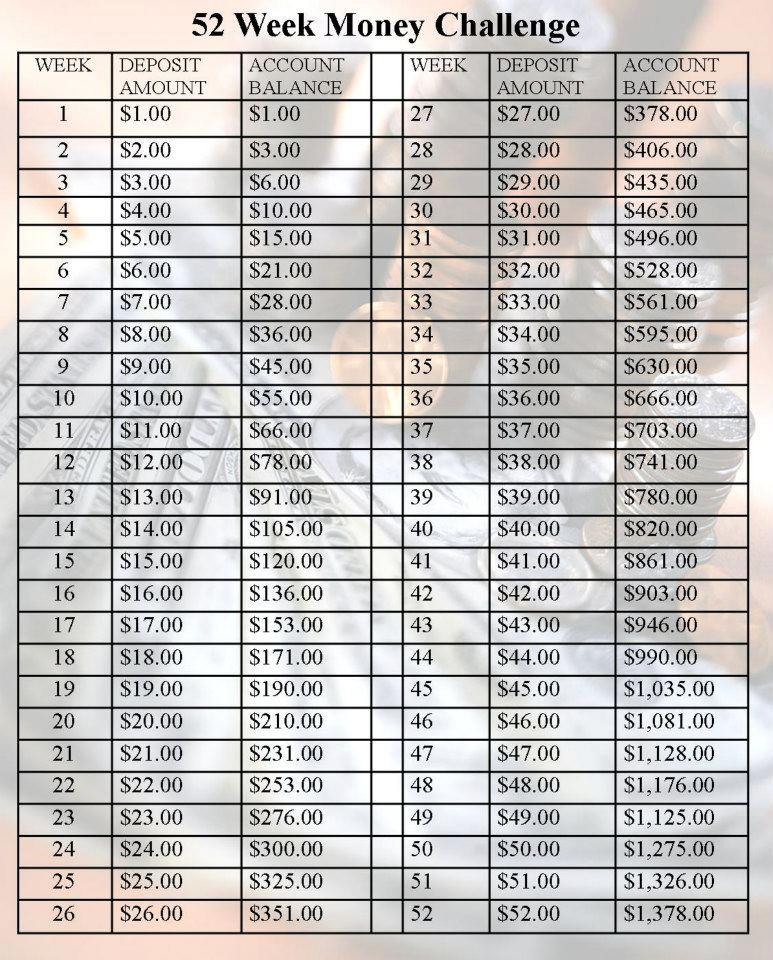

The concept is that you save a little each week, starting with $1 and adding $1 to it each week. So week 1 you save $1, week 2 you save $2, week 3 you save $3, etc. At the end of the first month you have $10 saved, at the end of the second month you have $36 saved. Doesn’t sound like much, but at the end of 52 weeks (1 year) you have $1378 saved!

The most you ever put away on any given week is $52 and that’s not until the end.

Or you can start the savings plan in reverse. Start with $52, then $51, then $50, etc.

I had meant to start this at the first of the year but we’ve been super busy. But I’m going to pretend I did. So now it’s the 4th week of the year, so I need $10 put back in my fund.

What am I saving for? Another Disney cruise of course! We just got back from one it was WONDERful! I’m actually going to do this two-fold. I’m going to put just as much in savings as I put back for our cruise. What are you saving for? A trip? A car? A rainy day? Share with us and we can encourage each other as we go! You can start this plan whenever you want and that would be your week 1. If you want to play catch up like I am, then we’re on week 4 and you need to put $10 back this week. If you’re doing it in the reverse then you’re on week 49 and you need to put back $202. Week 4: Put back $4 for a total of $10 saved. Week 49: Put back $49 for a total of $202 saved. Don’t forget to let us know what you’re saving for!

I’ve been seen this all around the internet, but it seems to me that it’s for people who have the money but spend it carelessly. I follow blogs like this because we just don’t have the money. I never have $10.00 or more than doesn’t have a place to go (bills, school, etc.). By the end….having $50 extra in a week? Haha! Having $200+ extra in a month. Crazy talk!

This is just one of may ways to save. If you can only do $10/week then by the end of the year you would have $520.

Some people give up their daily cup of coffee or soda from the drink machine and just save that $1/day. At the end of the year that’s $365.

When I did this plan, I found creative ways to find the extra money. Consigned some old clothes, had a yard sale, saved change for a month, etc. To come up with the money. If you’re getting taxes back you can put some of it up for first month or two’s savings. You can also start backwards if you have a big chunk of money to save now and work your way backwards through the weeks. So you would put back $52, $51, $50 and $49. And go that way.

But even if it’s putting a dollar a day in a jar – it’s a step in the right direction!

I actually encouraged all of my employees to do this at work. We keep it in the company safe to help them save for Christmas or whatever they like. We go from end to end…. They get paid every two weeks so on week one they paid $1 and on week $2 they paid $52. So really each paycheck they give me $53 to add to their fund! They love it! So rather than trying to give $202 for first 4 weeks or the last 4 weeks they only give $106. Hope that makes sense! Happy couponing!

That’s a great idea!